The Loose Change Revolution

Newly emerging: a decentralized investment world where loose change, even as small as pennies (or their currency equivalents across the world), can add up to capital gains for ordinary consumers.

Want to own part of a luxury apartment block in Cape Town, South Africa, for $10.00? Or buy a crypto currency coin based in Dallas Fort Worth, Texas, for less than 20 cents? Or perhaps go to CoinBase and spend 5 cents to buy some other coin with a different underlying proposition, or consider one of about 30,000 different listings there? Perhaps buy 100 crypto coins for one cent? Or 1,000 coins for a cent? Or do some financial literacy training and be rewarded with a free cryptocurrency bonus? Or buy some goods and services online and have digital currency assets added to the digital your wallet in your phone as a free reward? These are just a few samples among the tens of thousands of “opportunities” that await those who are prepared to look, to experiment, and learn to invest in the emerging, decentralized financial world.

In the context of human flourishing and publishing good stories of good, Veritas Chronicles is exploring the vast array types of opportunities being promoted, and the bona fides of those who promote them. As has always been the case for millennia, there are those who will try to fleece the vulnerable. We are watching for those too. While Veritas Chronicles is not an investment advisor or financial broker, not part of the buy/sell industry, we are committed to shining a light where we see value and integrity as part of our social impact / financial literacy initiative.

Accessibility is more widespread than ever. No one has the exact numbers, but those with phone access, and online access, and those who occasionally have access to a few cents or even a few dollars from time to time, constitutes the vast majority of earth’s population.

We live in an era where communications and DeFi — decentralized finance — are making more egalitarian the possibility of adopting an investment mindset and building a portfolio. Risk is always a factor. The chance to risk only pennies rather than large accumulations of dollars to test and experiment, is part of that welcome, egalitarian change.

Human Flourishing and the Power of Tiny-Scale Investments in the Third World

Understanding the current state of global poverty is a crucial starting point for developing strategies that enable the world's most disadvantaged populations to access micro-investment opportunities. Why? Because, context is critical to understanding. For example, in the USA, a family of four is considered to be living below the poverty line if their income is less than $2,500 per month. Whereas, in Senegal, a family living on $2,500 per year would be considered as “doing very well, thank you!”

Human flourishing, the full realization of an individual's potential across economic, social, and health dimensions, remains an elusive goal for hundreds of millions in the developing world. Historically, well-intended aid has often failed to create sustainable pathways out of poverty. As Clayton Christensen argues in The Prosperity Paradox, donations and large-scale aid frequently address symptoms rather than root causes, leaving recipients dependent rather than empowered. The key to sustainable change lies not in handouts but in the creation of market-based opportunities, particularly in a way that allows even the most marginalized individuals to participate in economic growth.

Overview of income/poverty by numbers and population concentrations:

Extreme Poverty: As of recent estimates, approximately 712 million people live on less than $2.15 per day (less than $800 per year), accounting for nearly 1 in 11 individuals worldwide (worldvision.org).

Upper-Middle Income Poverty Line: Around 3.5 billion people, or 44% of the global population, live on less than $6.85 per day (less than $2,500 per year), a standard more relevant for upper-middle-income countries (worldbank.org).

Regional Concentrations:

Sub-Saharan Africa: This region has the highest rate of children living in extreme poverty, with 40% affected. Notably, nearly 90% of children in extreme poverty reside in either sub-Saharan Africa or South Asia (worldvision.org).

South Asia: Countries like India and Pakistan have significant portions of their populations living in poverty. For instance, in India, approximately 64.9% of the population faces poverty challenges (sapa-usa.org).

Implications for Micro-Investments:

Given that a substantial portion of the global population lives on less than $6.85 per day ($2,500 per year), introducing micro-investment opportunities with entry points as low as $5 in some cases, or $1.00, or mere cents in some cases, could be transformative.

Such initiatives would need to be tailored to the economic realities of these regions, ensuring accessibility and affordability. Leveraging digital platforms and mobile technology could facilitate the inclusion of these populations in micro-investment opportunities, promoting financial empowerment and contributing to poverty alleviation.

The advent of digital currencies, tokenized assets, and decentralized finance (DeFi) presents an unprecedented opportunity to extend financial inclusion to those previously excluded from traditional banking and investment systems.

By understanding these demographics and economic conditions, and with the advent of blockchain/DeFi, more stakeholders can design and implement investment platforms that cater to the needs of the world's poorest populations, fostering economic inclusion and supporting human flourishing.

The decentralized financial revolution allows individuals to invest in ways previously unimaginable, empowering them (possibly) to take control of their financial future while fostering broader well-being in their communities.

Beyond Aid: The Need for Sustainable Investment

Christensen's insights highlight the flaws of traditional aid-driven development models, which often foster dependency rather than self-sufficiency. While philanthropy and government assistance may alleviate short-term suffering, they do not create the conditions for long-term prosperity. Sustainable economic development arises when individuals and communities participate in market-driven solutions that generate employment, innovation, and self-reliance.

Investment, rather than aid, serves as the foundation for lasting change. However, conventional investment avenues remain inaccessible to the vast majority of the world’s poor due to barriers such as high minimum investment thresholds, lack of collateral, and exclusion from formal banking systems. This is where digital financial tools can make a transformational difference.

Micro-Investments and the Promise of Tokenization

Tokenized assets and fractionalized investments enable participation in wealth creation at previously unimaginable scales. Blockchain-based systems allow for fractional ownership of property, businesses, and other assets, meaning that even individuals with minimal savings, or “loose change,” can invest pennies rather than hundreds or thousands of dollars.

For instance, a rural farmer in Sub-Saharan Africa or a street vendor in Southeast Asia could invest the equivalent of a few cents in a community-based renewable energy project or agricultural cooperative token. These investments, though small individually, aggregate into substantial financial flows that empower local entrepreneurs and enable productive enterprise, while offering the possibility of income or capital gains, or both, for the “penny” investor.

Furthermore, decentralized finance platforms facilitate peer-to-peer transactions without the need for costly intermediaries. Smart contracts ensure transparency, reducing corruption and inefficiency while allowing investors of all sizes to track their contributions and earnings in real time.

Financial Inclusion as a Path to Holistic Well-Being

Economic prosperity cannot be viewed in isolation from health, education, and overall well-being. When individuals gain even modest financial security through small-scale investments, their ability to afford healthcare, nutritious food, and education improves. Increased prosperity fosters a virtuous cycle: better health enables more productive work, while greater educational access expands future opportunities.

For example, women in developing nations often struggle to access capital due to systemic barriers. With decentralized finance, women can invest in cooperative agricultural projects or local businesses, yielding returns that fund their children’s education and medical care. By breaking the cycle of financial exclusion, these new models of investment contribute to the overall well-being of families and communities.

Challenges and Ethical Considerations

While digital financial innovations hold promise, they also pose risks. Without proper education and safeguards, vulnerable individuals could be exposed to scams, volatile markets, or exploitative schemes. DeFi and blockchain models help ensure that digital investment platforms remain transparent, accessible, and user-friendly. While financial literacy training can help prevent exploitation.

Summary: A New Vision for Human Flourishing

Market-driven solutions where the focus is better access and more egalitarian outcomes, coupled with the rise of decentralized finance, provides a compelling new approach to human flourishing for the many rather than the few. Rather than relying on ineffective aid programs, tiny-scale investments via digital currencies and tokenized assets can empower the disadvantaged to take control of their financial futures. By fostering economic inclusion, these innovations contribute not only to financial well-being but also to improved health, education, and overall quality of life.

As we move into a future where decentralized financial tools become more widespread, it is crucial to ensure that these systems remain ethical, inclusive, and geared toward genuine empowerment. If implemented correctly, this new financial landscape has the potential to transform many millions of lives, creating pathways to prosperity that are truly sustainable and accessible to all.

Learn and Earn: A Robust Example of DeFi Empowerment

What is “Learn and Earn?”

Financial literacy remains a significant barrier for many unbanked, underbanked and underserved individuals. The following “Learn-and-Earn” example allows participants to gain financial knowledge while simultaneously earning digital currencies or tokens.

This dual approach reduces the risk associated with trial and error, empowering individuals to experiment and learn without fear of financial loss. Such a process fosters an upward spiral in the growth loop: transitioning individuals from consumers to learners, investors, capitalists, and eventually contributors to social impact initiatives.

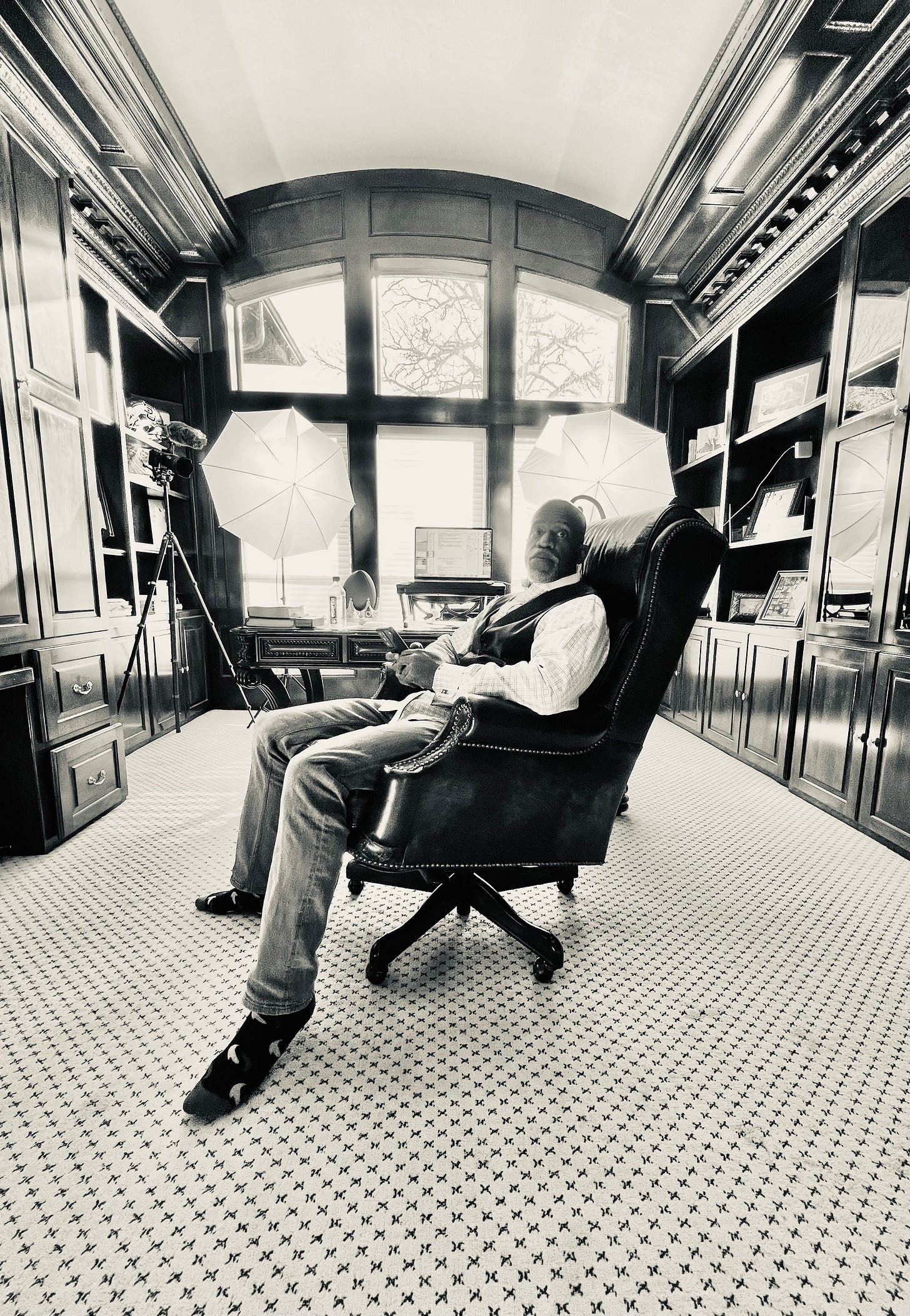

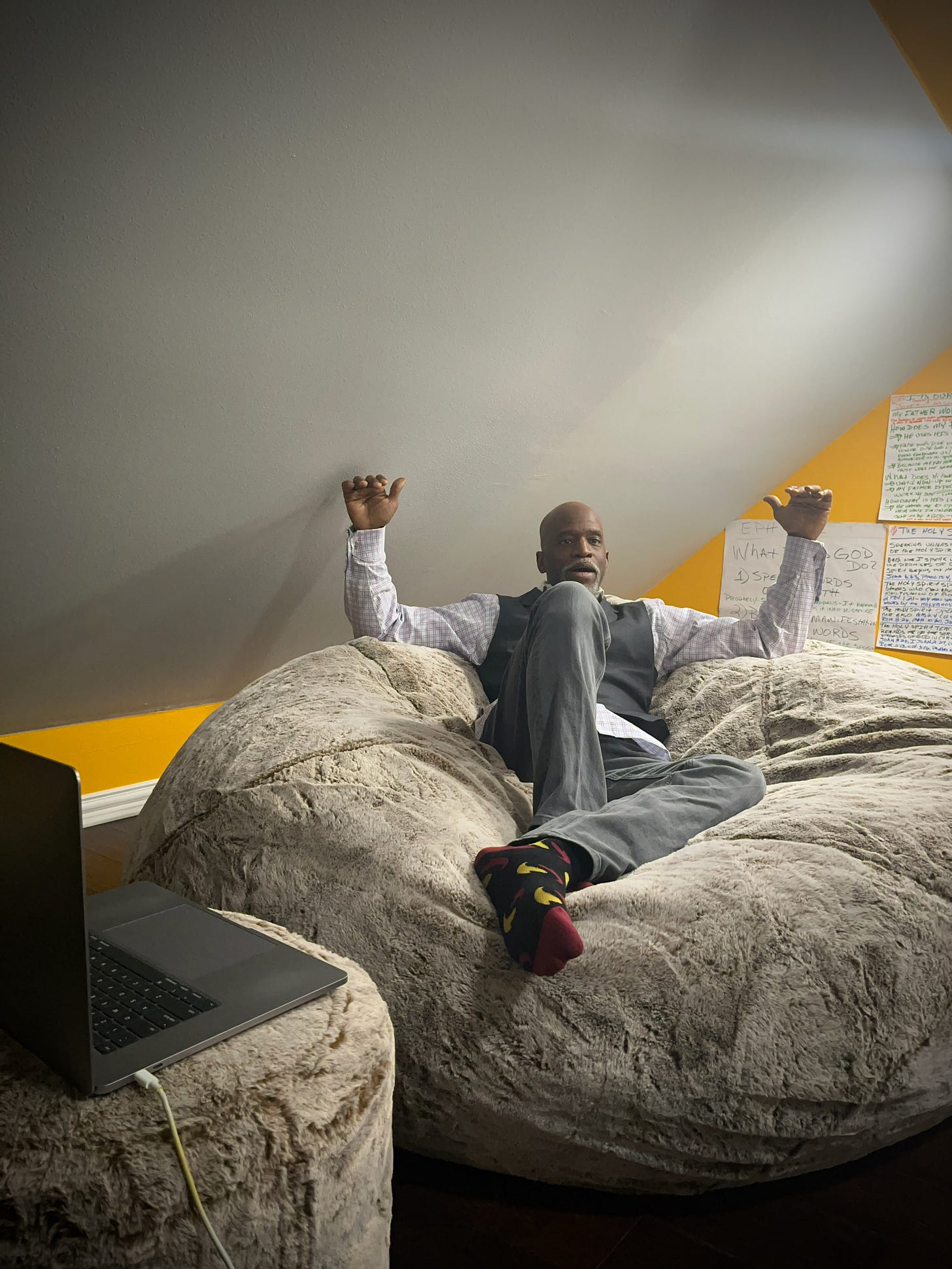

Dr. DL Wallace, CEO of Success Training Institute, and his wife, Dr. Melva Wallace, President of Huston-Tillotson University in Austin, Texas, have been demonstrating the efficacy of soft skills training1 to help raise the next generation of entrepreneurs for more than a decade. Their learning company Success Training Institute (STI) (SimplySuccess.com) is the premier soft skills training and learning management system in the US, with a growing international base. As well as serving dozens of universities and colleges and an array of businesses across America, STI offers scholarships to lower socio-economic schools and individuals to encourage a breakout from the generational poverty cycle.

A systematic approach to soft skills learning can accelerate any career or life choice, at any age, and in almost any circumstance. According to STI, more than seven out of ten college graduates say their careers would be better with soft skills training.

"It's the way out, the way up for everyone," comments DL Wallace. "We originally launched STI, and now we have established ImpactU, to bring that uplifting and transformative message to America and other parts of the world," he said.

While soft skills training was already a “leg up,” providing egalitarian access to all levels of education across the socio-economic spectrum, with the help of blockchain and decentralized finance systems, the Wallaces have added an extraordinary dose of financial literacy and zero risk “capital gains” opportunity to their education platforms.

Meet DL in the following link, and hear from his own mouth the essence of “Learn and Earn” … https://impactu.global/education-re-imagined-real-rewards/.

In the ImpactU system, while learning a variety of employment, business and social skills, growing careers and general functionality, subscribers are also earning digital currency credits — ImpactCoins. Each learning activity is paired with a cryptocurrency reward, an ImpactCoin. Each ImpactCoin has an immediate and growing value on cryptocurrency exchange platforms. In this way, learners are enabled to increase their educated, human flourishing capacities, while also being able to own, trade or sell, or hold and watch their financial asset grow.

Authors’ Note: The authors know the Wallaces very well, have watched them build their social impact strategies and launch them to the world. The Wallaces “Learn and Earn” model provides an excellent example of the positive principles we admire in the The Prosperity Paradox being put to work in the real world. §

What are soft skills?: According to Dr DL Wallace, the simple definition is this — “The interpersonal traits that govern how we lead and interact with people, solve problems, manage emotions and achieve goals.”