The Looming Crisis of Age and Money

Consider: (a) an aging population, (b) longer lives, (c) the dumbing down of American schools, (d) a weaker workforce and lower tax base , (e) an unsustainable birth rate, (f) the sharply rising cost of healthcare, and (g) the disproportionate cost of healthcare for the elderly. Together, they spell, l-o-o-m-i-n-g d-i-s-a-s-t-e-r.

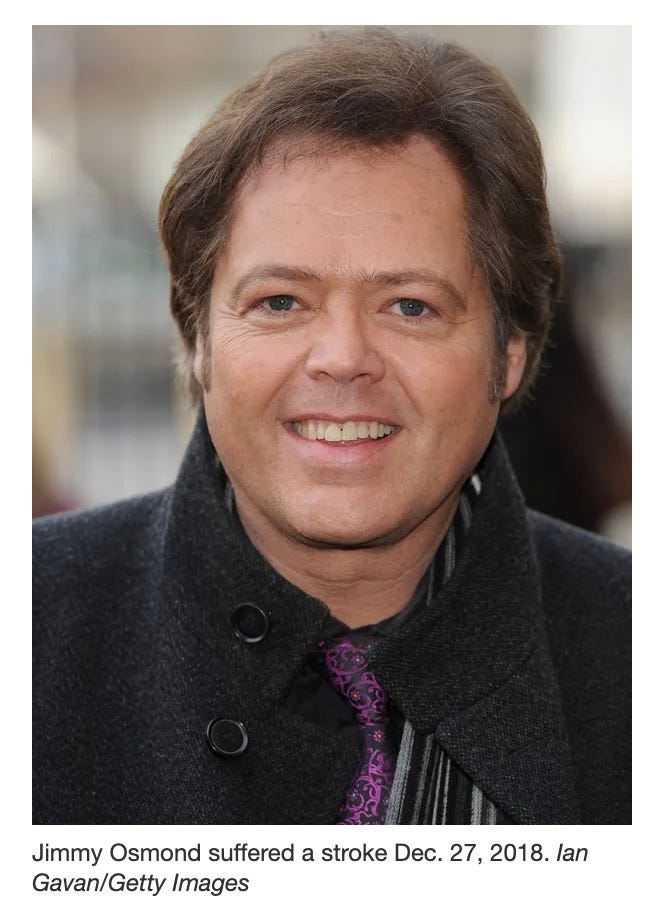

Jimmy Osmond, the youngest of the Osmond singing group, was unintentionally the inspiration for this significant story. Jimmy is 61 — and — while still living an active life, the quality of that life, and its priorities have been severely impact by a 2018 stroke. What happened when he had that stroke in the UK delivers serious food for thought.

I met Jimmy in late 2018 when he was living in Branson, Missouri, just a few months before his life altering stroke. Branson is famous for the summer performances at theaters owned by many of the most famous performers in America.1 Jimmy owned the Andy Williams Theater,2 and was considering a hotel and conference center addition to the complex. I was with my friend and business partner, Glen Overton, an acknowledged expert in hospitality. Glen was a long time friend of the Osmond family and had dealings with many of the Osmonds over the years. We had been invited to help develop the complex. Our hospitality development conversations with Jimmy were put on hold temporarily, we thought, while Jimmy headed off to do his annual Christmas performance tour in the UK.

While performing as Hook in Peter Pan, in Birmingham, England, on December 27, 2018, Jimmy suffered a stroke. No one knew what the outcome would be at the time, but eventually it meant the end of his performing career, the end of his plans for the Andy Williams Theater, and a great many other adjustments.

Though only 55 at the time, when Jimmy entered the UK health system because of his health emergency, the system considered him too old to be a high priority for recuperative treatments. The UK health system prioritizes younger people with longer life spans and apparently “more to give.” At this stage of my life, I consider someone aged 55 to be still up and coming, just entering their most productive years. Jimmy thought so too. Even though he had been very famous from his childhood, he was very much engaged in both entertainment and business, along with a large and active family life.

In the end, to get the treatment he needed, his wife Michelle, rushed over to the UK and arranged to bring Jimmy home to the USA where she expected the health system would be more interested in his welfare. It was. It is.

This is not to say the UK is right or wrong. Or that the US is right or wrong. But they are very different in their priorities. Jimmy’s emergency brought those differences forcefully to my attention. Now, six years later, and counting, the issues that help define those differences are even more prescient. An almost existential crisis is looming —

An aging population

Longer lives

The dumbing down of American schools3

A smaller workforce and proportionally smaller taxpayer base

An unsustainable birth rate

The sharply rising cost of healthcare

The disproportionate cost of healthcare for the elderly4

Together, they spell, l-o-o-m-i-n-g d-i-s-a-s-t-e-r for the most vulnerable.

The Aging Population and Health Crisis: Economic, Personal, and Ethical Considerations

The modern world is experiencing an unprecedented demographic shift: populations are aging rapidly, birth rates are declining, and healthcare costs for older individuals are rising disproportionately. These trends pose ethical, economic, and social dilemmas that challenge both secular policymakers and religious traditions. Among these, the Judeo-Christian ethic, with its emphasis on the sanctity of life, care for the vulnerable, and moral responsibility, provides a valuable framework for assessing possible solutions to these pressing issues. We are considering here the global impact of aging populations, the economic burdens they create, and the ethical considerations surrounding end-of-life care, using a Judeo-Christian perspective as a guiding principle.

American writer and novelist Pearl Buck (1892-1973), best known for her novel, The Good Earth (winner of the Pulitzer Prize in 1932), and recipient of the Nobel Prize for literature wrote: “Our society must make it right and possible for old people not to fear the young or be deserted by them, for the test of a civilization is the way that it cares for its helpless members.”

Hubert Humphrey (1911-1978) served as U.S. Vice President from 1965 to 1969. In 1976, he said: “The ultimate moral test of any government is the way it treats three groups of its citizens. First, those in the dawn of life — our children. Second, those in the shadows of life — our needy, our sick, our handicapped. Third, those in the twilight of life — our elderly.”5

I. The Aging Population and Declining Birth Rates: A Global Perspective

Across the developed world, societies are grappling with the dual challenge of increasing life expectancy and decreasing fertility rates. Countries such as the United States, Canada, the United Kingdom, Australia, and those in the European Union are experiencing demographic shifts where the proportion of elderly citizens (65 and older) is growing while the younger, working-age population is shrinking.

1. The Economic Implications

As the workforce contracts, fewer taxpayers are available to fund social programs such as pensions and healthcare. This results in a heavier burden on government budgets, employer-sponsored insurance, and families. Governments struggle to balance the need for elder care while maintaining economic stability.

2. Some International Comparisons

· United States: Relies on a combination of private insurance, employer contributions, and government programs such as Medicare and Medicaid. The rising cost of long-term care is forcing debates over public funding and private responsibility.

· Canada & EU Nations: Implement single-payer systems, where healthcare costs are managed through taxation. However, rationing of care based on age and cost-effectiveness assessments is increasingly controversial.

· Japan: The most aged society in the world, Japan is pioneering robotics and community-based care to handle the rising number of elderly citizens with fewer caregivers available.

From a Judeo-Christian perspective, societies must prioritize care for the elderly without resorting to policies that treat aging as a burden rather than a natural stage of life.

II. The Disproportionate Cost of Healthcare for the Elderly

Medical expenditures increase significantly with age, particularly due to chronic illnesses such as cardiovascular disease, dementia, and diabetes. A significant portion of healthcare spending is concentrated in the last years of life, with costs often exceeding what younger generations contribute in taxes or insurance premiums.

Who Pays?

· Families: Increasingly responsible for elder care, leading to financial strain.

· Employers and Insurers: Face rising premium costs due to older employees and retirees.

· Governments: Struggle to maintain funding for Medicare, Medicaid, and pension programs.

III. Age-Based Restrictions on Services

As healthcare costs rise, some countries are implementing policies that ration care for older adults. This can take the form of limiting certain surgeries (e.g., hip replacements or organ transplants) based on age, or prioritizing younger patients for intensive care units.

1. Ethical Concerns

From a Judeo-Christian standpoint, such policies risk treating human dignity as conditional on productivity or youth, contradicting the Biblical command to "honor your father and your mother" (Exodus 20:12).

2. Real-World Examples

· United Kingdom’s NHS: Uses cost-effectiveness assessments to determine whether life-extending treatments should be covered.

· Canada’s Healthcare System: While universal, access to specialist care for older adults can be delayed due to triage decisions.

· U.S. Medicare: Funds many high-cost procedures for the elderly but faces financial sustainability challenges.

Alternatives include strengthening palliative care options that align with religious principles of compassion and dignity.

IV. End-of-Life Scenarios and the Euthanasia Debate

A growing number of countries are legalizing euthanasia and assisted suicide as a response to chronic illness, disability, or perceived loss of dignity. The Netherlands, Belgium, and Canada have expanded their euthanasia laws to include non-terminal conditions, while the U.S. has legalized assisted suicide in select states.

1. Perspective on Life and Death

Judeo-Christian values affirm that life is sacred and belongs to God, with suffering seen as part of the human experience rather than justification for ending life. The Catholic Church, most evangelical Protestant denominations, and Orthodox Judaism all oppose euthanasia, emphasizing palliative care instead.

2. The Slippery Slope of Legalized Euthanasia

Opponents of euthanasia argue that it can lead to coercion, where elderly or disabled individuals feel pressured to end their lives due to economic burdens or social isolation. Reports from Canada and the Netherlands indicate cases where patients opted for assisted death not due to unbearable suffering, but due to financial hardship or lack of adequate care.

3. Solutions Within the Judeo-Christian Ethical Framework

· Hospice and Palliative Care: Expanding access to compassionate, faith-based end-of-life care.

· Stronger Mental Health and Social Support: Ensuring individuals do not choose euthanasia out of despair or loneliness.

· Moral Guidance in Healthcare: Encouraging medical professionals to adhere to ethical standards that respect human dignity.

V. Addressing the Challenges: Policy and Ethical Solutions

Aging populations and healthcare burdens require both policy innovation and ethical considerations rooted in respect for life. Possible solutions include:

1. Strengthening Intergenerational Support

· Encouraging family-based elder care: Aligns with Biblical principles of familial responsibility.

· Tax incentives for caregivers: Helps families afford in-home care.

2. Sustainable Healthcare Funding

· Hybrid public-private models: Ensuring affordability while maintaining quality care.

· Faith-based community healthcare: Expanding religious hospital networks to provide non-profit elder care.

3. Promoting Ethical End-of-Life Care

· Resisting euthanasia expansion: Protecting vulnerable populations from coercion.

· Investing in spiritual care services: Addressing existential suffering without resorting to assisted dying.

Individual and Family Choices Can Mitigate the Circumstantial Challenges

The global existential issues are the realm of governments and institutions. Not many individuals can have a profound impact on global trends. However, there are choices that individuals and families can make to reshape their private circumstances. Here are two. One is philosophical, the other is practical.

Family. The fundamental answer to most of the above issues is family. It’s individuals with families making deliberate choices about their connectedness. In the most sustainable societies cultures throughout history, multigenerational living has been a traditional practice. This applies not just to Christian or Judeo-Christian families. There are strong multigenerational traditions across almost all cultures — Hispanic, Asian, and Indigenous Peoples. Governments and health care institutions can lend support to a family-based system, but families who choose to provide their own support ecosystem serve all their generations, including the elderly, best. The multigenerational family structure, whether living under one roof or in close proximity, offers invaluable benefits for both the young and the old. For children and youth, it can provide a rich tapestry of love, support, and shared wisdom. Grandparents and other elders offer unique perspectives, life lessons, and a sense of continuity, strengthening family bonds and fostering a strong sense of identity. This constant presence creates a stable and nurturing environment, bolstering emotional well-being and contributing to healthy development. Simultaneously, this arrangement provides a vital support network for aging family members. It offers companionship, reducing isolation and loneliness, while also providing practical assistance with daily tasks, healthcare needs, and emotional support. This reciprocal relationship benefits everyone involved, creating a strong foundation for raising children and ensuring that the wisdom and experience of the aged are honored and valued within the family unit; and that the financial burden of aging is borne at the most basic level of society.

Health Matching Accounts. Here we rely on the expertise of John C. Goodman, Ph.D. President and CEO Goodman Institute for Public Policy (a 501(c)(3) nonprofit organization) — in his report —

A New Approach to High Deductibles

High deductible health insurance is an irritation for many of us. In fact, health insurance with, say, a $10,000 deductible is almost like not having health insurance at all. So, what can be done? One option is to buy down the deductible by paying a higher premium for less exposure. But people who try that often confront an unpleasant reality: the extra insurance you can obtain by buying down the deductible is the most expensive insurance there is. In fact, eventually you will reach a point where an extra dollar of coverage costs more than a dollar of premium.

There are two reasons for that. First, small dollar claims occur more often than large dollar claims. Second, there is an adverse selection effect. The people who are the most likely to want a lower deductible and who are the most willing to pay a steep price to get it are the ones who are the most likely to file claims. In other words, they are sicker than people who select high deductibles and bear the first-dollar risk themselves. Insurance companies know this and they price their policies accordingly.

A second option is to self-insure for the exposure under the deductible. For example, to protect yourself against the first $10,000 of medical expenses, you could put $10,000 in a dedicated account, such as a Health Savings Account. The problem is that most families don’t have the money to do that. And if they make small monthly deposits to an HSA, it will take a long time to fill the deductible amount – even if they stay healthy and don’t have any medical bills.

For example, assume that the family deposits $140 a month to the account. It will take three years to accumulate just half the amount of the deductible.

A third possibility is for people with high deductible plans to get together as a group and insure each other for the expenses under the deductible. This would be a separate cooperative arrangement – completely detached from their primary insurance plan. But how can folks with no experience in the business pull that off? Fortunately, they don’t have to. As I explained in a recent post at Forbes, a Houston based firm called Health Matching Account Services is ready to do it for them with a brand-new insight: if you make monthly contributions to increase the amount of coverage you have, you can cover your deductible a lot faster than if you try to build up a cash account. What you get in return for your contributions is something akin to the Medigap insurance seniors buy to fill the gaps in Medicare. (Note: The Department of Insurance has determined that the HMA® product is not insurance.)

Moreover, unlike conventional insurance, these accounts don’t go away at year end. Provided there are no medical expenses, they keep on growing year after year. In other words, this type of insurance is always there until it’s used. HMA’s also differ from conventional Health Savings Accounts in that the balance is available to pay medical bills. Money can never be withdrawn for non-health care purposes.

How Individuals Can Insure For A High Deductible

To continue with the above example, instead of putting $140 a month into a bank account, suppose people instead sent that money to an HMA in the form of a contribution. After 12 months, they will have paid $1,680. For that amount, they will have coverage for the first $1,980 of medical expenses. In other words, the buyers are getting $1.17 in medical benefits for every $1.00 they pay in contributions, on the average. Things get better in year two (where you get more than $3 of coverage for every $1 contributed) and better still in year three (where you get almost $7 of coverage for every $1 contributed). After 35 months of contributions, people with no medical bills will have their own medical coverage that completely fills the $10,000 deductible gap.

Would people have been better off putting those contributions in an HSA? The company gives this example. After 35 months, the total amount contributed will equal $4,900. So, the person with the HSA will have that much in the bank, but face $5,100 of exposure – should an expensive illness occur. By contrast, the person who paid HMA contributions will have nothing in the bank but will have $10,000 of coverage and no remaining exposure.

Now let’s suppose that a medical event occurs, costing $3,600. After the HSA holder pays this amount, they will have only $1,300 left in their HSA – according to the example the company provides. Since the HSA deposits are tax-advantaged, we could top up that amount to $2,525 (assuming a 25% tax bracket). But remember, if they try to withdraw the cash and spend on non-health consumption, they will pay taxes and penalties on the withdrawal.

Meanwhile, the person contributing into the HMA doesn’t get any tax relief, but they will still have $6,400 of medical coverage available. And, after only eight more months of contributions, they will have completely closed the $10,000 deductible gap once again. By the way, once an individual has achieved the $10,000 target level of coverage, they can maintain that level by making a modest payment of $40 per month. Going forward, they will have $10,000 of coverage for a price of roughly 5 cents on the dollar. Is this a good deal? If you tend to live paycheck-to-paycheck and have trouble saving for medical expenses, self-insuring against your deductible with an HMA may make more sense than trying to fund it with a savings account.

As reported in Forbes Magazine: https://www.forbes.com/sites/johngoodman Also see: https://healthmatchingaccounts.com

In a World of Tough Choices There is a Profound and Reliable Basis for Our Decisions

From a Christian or Biblical perspective, the call to care for the aged resonates deeply with core biblical principles. Scripture emphasizes the inherent dignity and worth of every human life, created imago Dei – in the image of God (Genesis 1:27). This inherent worth does not diminish with age; rather, the elderly, having lived through decades of experiences and contributions, deserve particular honor and respect. The Old Testament frequently emphasizes the importance of caring for the elderly, associating it with wisdom and reverence (Leviticus 19:32). The New Testament echoes this, with Jesus himself emphasizing love and compassion for all, especially the most vulnerable (Matthew 25:40).

To limit healthcare services based solely on age contradicts these fundamental teachings. Such a system implies that the lives of older individuals are somehow less valuable or that their contributions are finished. This ignores the spiritual richness and wisdom that often accompanies aging. The elderly are not simply recipients of care; they are often sources of profound spiritual guidance, offering invaluable life lessons and a unique perspective on faith. They are members of our families, our churches, and our communities, deserving of the same dignity and care — if not more so — as may be afforded to anyone else.

Furthermore, a system that prioritizes youth over age disregards the interconnectedness of generations. We are called to honor our fathers and mothers (Exodus 20:12), a commandment that extends beyond childhood and implies a lifelong responsibility to care for those who came before us. How can we teach our children the value of compassion and respect if we deny these very things to our elders? A society that marginalizes its aged population risks losing not only their accumulated wisdom but also a vital part of its own soul.

From a Christian standpoint, healthcare should be driven by compassion and need, not by arbitrary age limits. While resource allocation is a complex issue, the inherent value of every human life, regardless of age, must be the guiding principle. Prioritizing the elderly is not simply a matter of fairness; it is a reflection of our commitment to the biblical principles of love, respect, and the inherent dignity of all human life, from the moment of conception to the natural end of life. It is a testament to our understanding that we are all part of the Body of Christ, each member deserving of care and compassion.

As it turns out, despite all of its flaws, and policy conflicts — and the perception that many Americans have turned away from God — the US is still the one country in the world that is least likely to scrimp when it comes to aged care, and most likely to spend disproportionately in favor of the elderly. There is something admirable to be said about that. §

Branson is an Ozark town in southwest Missouri known as a family vacation destination. Its 76 Country Boulevard is famously lined with theaters, which once hosted mostly country music performers but today present diverse entertainment. Also along the strip are the Marvel Cave, the Wild West-style Dolly Parton’s Dixie Stampede Dinner Attraction and Silver Dollar City, an 1800s-themed amusement park with live music.

The Andy Williams Moon River Theatre is a performing arts center in Branson, Missouri. It was founded by Andy Williams, who performed there until 2011. The theater has hosted many famous acts, including the Osmonds, Glen Campbell, Pat Benatar, and Phyllis Diller.

““William A.” graduated from Clarksville-Montgomery County Schools last year with a 3.4 GPA. The problem? He couldn’t read the words on his diploma. He couldn’t even spell his own name.” Reported in The Free Press, February 13, 2025 — “Studies show that the Covid generation is nearly eight IQ points less intelligent than their slightly older peers because of lockdowns. Reading and math scores are at their lowest in decades. On TikTok, teachers have reported mass illiteracy and declining attention spans.” — thefp.com

The US government reports (cms.gov), that healthcare spending varies significantly across different age groups, reflecting the changing health needs throughout an individual's life. Here's an overview of per capita personal healthcare spending by age group: Children (0-18 years): In 2020, per capita spending was approximately $4,217. Working-age adults (19-64 years): The average spending was about $9,154 per person in 2020. Older adults (65 years and older): Per capita spending was significantly higher, at $22,356 in 2020. These figures illustrate that healthcare costs increase with age, with individuals aged 65 and over incurring more than twice the expenses of working-age adults and over five times that of children.

https://atkinsbookshelf.wordpress.com/2018/02/21/famous-misquotations-a-civilization-is-measured-by-how-it-treats-its-weakest-members/