Decentralization and Tokenization Lead to Democratization | The Opportunity for an Investor Mindset at the "Other End" of the Financial Spectrum

Global financial decentralization via blockchain, coupled with digital currencies and tokenized real world assets, offers a new world of financial egalitarianism.

Introduction

The financial world has traditionally been a space dominated by those with access to wealth, resources, and knowledge. For the unbanked and underbanked populations—comprising billions of individuals worldwide—participation in this realm has often seemed out of reach. However, technological advancements, particularly in decentralization and tokenization, are reshaping the landscape of global finance. By lowering the barriers to entry, leveraging blockchain security, and embracing worldwide accessibility through mobile and online platforms, these innovations are creating unprecedented opportunities for those who have been historically locked out of the investment world. These developments are democratizing finance, and intrinsically include the wherewithal to foster a growth-oriented mindset for the (presently) socio-economically disadvantaged.

Anomalous America: the USA as a Sampling of a Greater Worldwide Phenomenon

According to Forbes Magazine,1 more than 180 million American adults live paycheck to paycheck. US median income is only $38,000. The majority of US adults spend every dollar they get as soon as it comes in, trying to make ends meet; savings are scarce or non-existent. A 2024 survey reported in Yahoo Finance found that 50% of Americans have $500 or less in their savings account, with 36% having $100 or less. A family needing new tires, or experiencing an unexpected health expense, puts at least half of all US families into emergency mode.

Yet, this segment spends a combined $6.91 trillion every year — can that amount of money do more, much more? Yes, it can. In a decentralized ecosystem, there is more than enough margin to fund, support and sustain alternative systems that elevate constituents, from even the humblest of beginnings, in an upward spiral.

It is an amazing anomaly that the richest country in the history of the world has such a large poverty factor, and that the majority of its adults struggle to make ends meet, month by month. While poverty, to the extent that may be seen in the world’s poorest nations is seldom seen in the USA, multi-generational poverty is rampant, and the percentage of people who are struggling to make ends meet is increasing, not diminishing. The US should be providing economic leadership, proving there are better ways, not growing in poverty levels and classes.

The world’s wealth is growing but the wealth / poverty gap is systemically widening rather than narrowing. On the other hand, there is no need for a modern-day-Robin-Hood-rob-from-the-rich-to-give-to-the-poor approach — decentralized systems are robustly egalitarian and more inclusive by their very nature.

The Challenges of Financial Exclusion

The unbanked and underbanked face a myriad of challenges. Traditional financial institutions often require documentation, credit history, or minimum balances that many people cannot provide. For those living in rural areas or developing nations, physical access to banks can be another insurmountable barrier. Even when access is possible, high fees and lack of trust in financial systems further alienate these populations. This exclusion perpetuates a cycle of poverty, as individuals lack the tools to save, invest, or grow their wealth.

Decentralization and Tokenization: Pathways to Inclusion

Decentralization and tokenization represent transformative forces in the financial world. Decentralization eliminates the need for intermediaries, allowing individuals to participate directly in financial ecosystems. Blockchain technology—the backbone of decentralization—offers transparency, security, and traceability, fostering trust among users.

Tokenization enables the fractional ownership of assets, making previously inaccessible investments available to a broader audience. Real-world assets (RWAs) such as real estate, infrastructure projects, and even material goods can be tokenized, allowing individuals to purchase small portions of these assets. For example, an individual in a South American rural village can invest as little as a dollar in a tokenized apartment block in West Africa or a 5-star hotel in Malta. These opportunities not only provide potential income and capital appreciation but also give investors a sense of ownership and participation in global economic growth.

Examples of Impactful Decentralized Tokenization

Real Estate Ownership in Developing Regions: Platforms such as Reitium2 or Lofty.ai3 allow individuals to purchase smaller scale and/or tokenized shares of real estate properties. This means that a small investor can own a fraction of an apartment complex or other real world asset, and benefit from rental income or property appreciation.

Infrastructure Projects: Companies are offering tokenized access to large-scale infrastructure investments, such as roads in Mongolia, bridges in Costa Rica, or airports in Peru. For example, the world’s largest fund manager, BlackRock, is in the process of tokenizing $10 trillion of real world assets. According to Forbes Magazine, “This innovation promises enhanced liquidity, evidence of ownership, and transparency, aimed at democratizing traditionally inaccessible investment avenues.”4 Whether large funds, or smaller initiatives, these types of investments not only provide potential financial returns but also contribute to local development, creating jobs and improving quality of life.

Renewable Energy Projects: Tokenized solar and wind farms allow small investors to contribute to sustainable energy initiatives. For example, individuals can own tokens representing shares in solar panels installed in remote communities, earning returns while supporting clean energy.

Agriculture and Supply Chain: Platforms like Agriledger use blockchain to tokenize agricultural assets, allowing small-scale farmers to access capital by selling tokenized shares of their future harvests. This empowers farmers to expand their operations and increase productivity.

Microfinance and Peer-to-Peer Lending: Tokenized lending platforms enable individuals to lend small amounts to entrepreneurs in underserved regions, earning interest while supporting local businesses. This model fosters economic growth and financial inclusion.

The Power of Micro-Investments

One of the most revolutionary aspects of this financial paradigm is the very low cost of entry. Loose change—often disregarded by those even in the lowest socio-economic strata—can now be leveraged to build a portfolio. Digital currencies with values of less than a cent can be purchased, or in some ecosystems earned as rewards, enabling individuals to take their first steps into the investment world. This accessibility transforms the narrative: from surviving on the margins to actively growing wealth.

Learn-and-Earn Models: Bridging Knowledge Gaps

Financial literacy remains a significant barrier for many unbanked, underbanked and underserved individuals. To address this, innovative ecosystems are combining education with earning opportunities. Learn-and-earn models allow participants to gain financial knowledge while simultaneously earning digital currencies or tokens. This dual approach reduces the risk associated with trial and error, empowering individuals to experiment and learn without fear of financial loss.

For instance, some platforms are designed to offer no-risk trial experiences where users simulate investments, gaining confidence and skills before transitioning to real-world applications. This process fosters an upward spiral in the growth loop: transitioning individuals from consumers to learners, investors, capitalists, and eventually contributors to social impact initiatives.

A Global Ecosystem for Empowerment

At Veritas Chronicles, we can see the vision of a global financial ecosystem where the unbanked and underbanked, and all levels of the socio-economic spectrum, can access and own both digital and physical assets. Such an ecosystem — rapidly emerging in our present era, but still a long way from mature — bridges the gap between the digital and real worlds, offering opportunities that have local social impact and global commercial value.

The accessibility of these opportunities is further enhanced by mobile and online platforms, which allow individuals from even the most remote areas to participate. With smartphone penetration increasing worldwide,5 more people are gaining access to these platforms, breaking down geographical and socio-economic barriers.

The Inescapable Link Between Wealth Momentum and Health Outcomes

Further, there is a startling and meaningful relationship between poverty and poor health — a steady increase of income or buying power steadily uplifts health outcomes. In the context of this article, wealth may mean just a few extra dollars per month, or a way to increase buying power through active pursuit of discounts, or establishing a savings account that isn’t raided to pay for groceries every week. It means many things to many people, so the “wealth” conversation is far more about momentum than quantum.

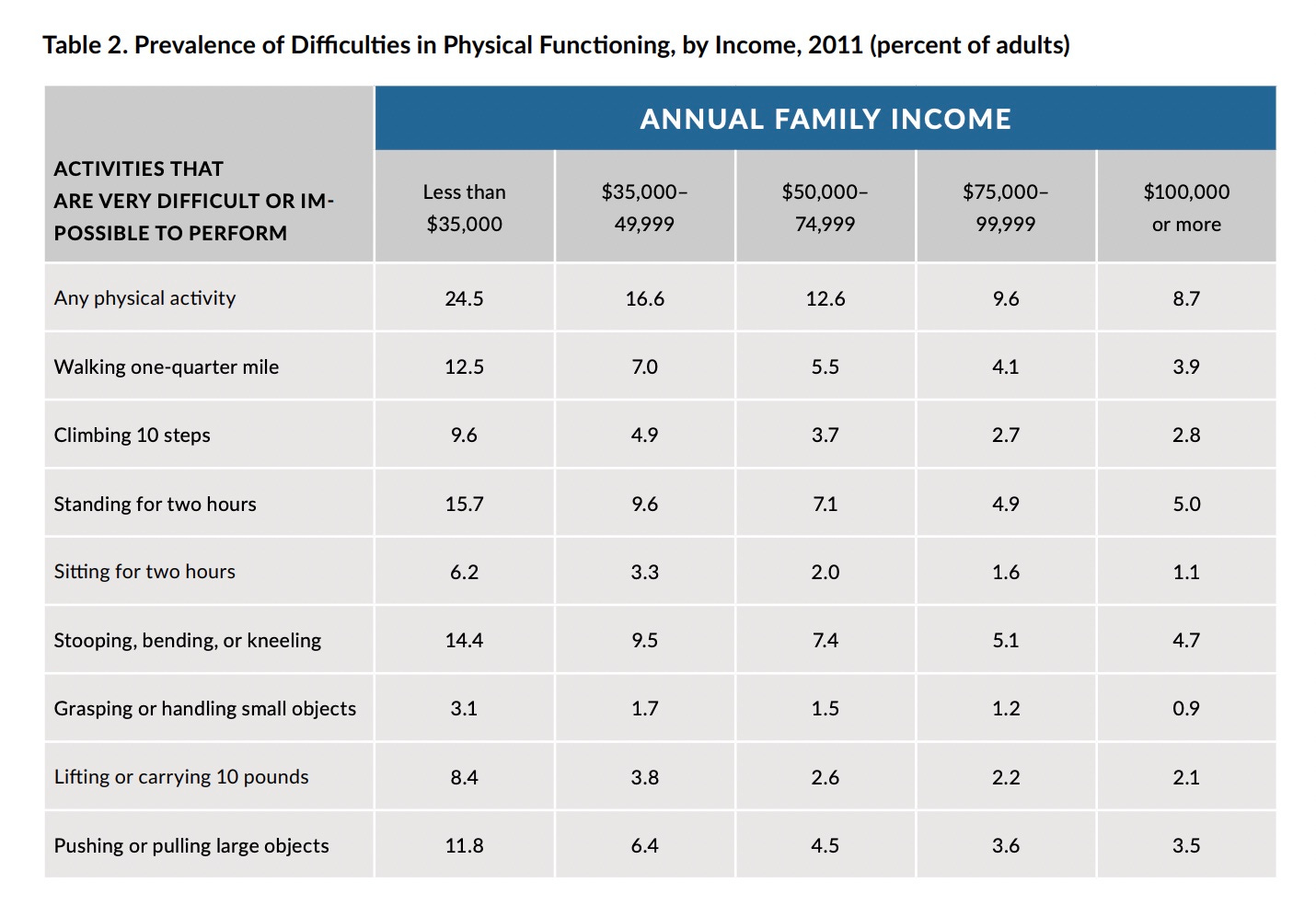

Regardless of anyone’s definition of “wealth,” a study in the USA, published in 2015, showed that there is a direct correlation between health and income. The study is in the footnotes, but here is a sample of the startling findings —

“The relationship between income and health is a gradient: they are connected stepwise at every level of the economic ladder. Although Blacks and Hispanics have higher rates of disease than non-Hispanic whites, these differences are “dwarfed by the disparities identified between high- and low-income populations within each racial / ethnic group.” That is, higher-income Blacks, Hispanics, and Native Americans have better health than members of their groups with less income, and this income gradient is more strongly tied to health than race or ethnicity.”6

In other words, every step upwards on the income or financial momentum ladder has a correlated effect towards increased health and reduced disease.

Completing the Growth Loop

The integration of decentralized finance, tokenized assets, and financial literacy initiatives completes a transformative growth loop. It begins with consumption but progresses through learning and investing, ultimately cultivating a “capitalist”7 mindset that encourages individuals to contribute to social impact projects. This loop not only uplifts individuals but also strengthens communities and economies at large.

For the billions of people stuck at the lower end of the financial spectrum, not just the truly impoverished (but also including them), this shift represents more than just financial inclusion; it is a redefinition of their economic potential. By participating in this new ecosystem, they are no longer relegated to the margins but can choose to be active players in a global financial narrative.

Conclusion

Decentralization and tokenization are not just technological advancements; they are tools of empowerment. By lowering costs, ensuring security, and providing accessible, education-driven opportunities, these innovations are democratizing the investment world. For the unbanked, underbanked, underserved, and all who are generally excluded from large-scale investments, this means breaking free from cycles of poverty and exclusion to embrace a mindset of growth and contribution. As these global ecosystems expand, they offer a future where everyone—regardless of socio-economic status—has the chance to own, invest, and thrive.

https://www.forbes.com/advisor/banking/living-paycheck-to-paycheck-statistics-2024/ | https://finance.yahoo.com/news/minimum-emergency-savings-needed-america | https://datacommons.org/place/country/USA?utm_medium=explore&mprop=income&popt=Person&cpv=age,Years15Onwards&hl=en | https://www.forbesindia.com/article/explainers/poorest-countries-in-the-world/87529/1

Reitum.org: “Our mission, deeply rooted in faith and compassion, is to transform church lands into beacons of hope and community, through the development of community centers, daycares, and affordable housing. We’re dedicated to creating nurturing spaces that reflect our core values of love and support, striving to meet the critical need for affordable living spaces with a spirit of unity and care.”

Lofty.ai: “The NASDAQ For Real Estate. Buy and sell real estate as effortlessly as trading a share of TSLA. Diversify across 150 properties in 40 markets starting at just $50 and sell with instant liquidity anytime.”

https://www.forbes.com/sites/nataliakarayaneva/2024/03/21/blackrocks-10-trillion-tokenization-vision-the-future-of-real-world-assets/

According to Statista.com, as of May 8, 2024: “The global smartphone penetration rate was estimated at 69 percent in 2023, up from 2022. This is based on an estimated 6.7 billion smartphone subscriptions worldwide.”

https://www.urban.org/sites/default/files/publication/49116/2000178-How-are-Income-and-Wealth-Linked-to-Health-and-Longevity.pdf

Capitalism: there are many dimensions to capitalism, many pros and cons, good and bad, with a range of uplifting and destructive examples. However, we are satisfied with this short definition from Harper College, that is consistent with the tenets of the Veritas Chronicles article: “The essential nature of capitalism is social harmony through the pursuit of self-interest. Under capitalism, the individual's pursuit of his own economic self-interest simultaneously benefits the economic self-interests of all others.”